I. Real-Time Identification and Validation of QREs

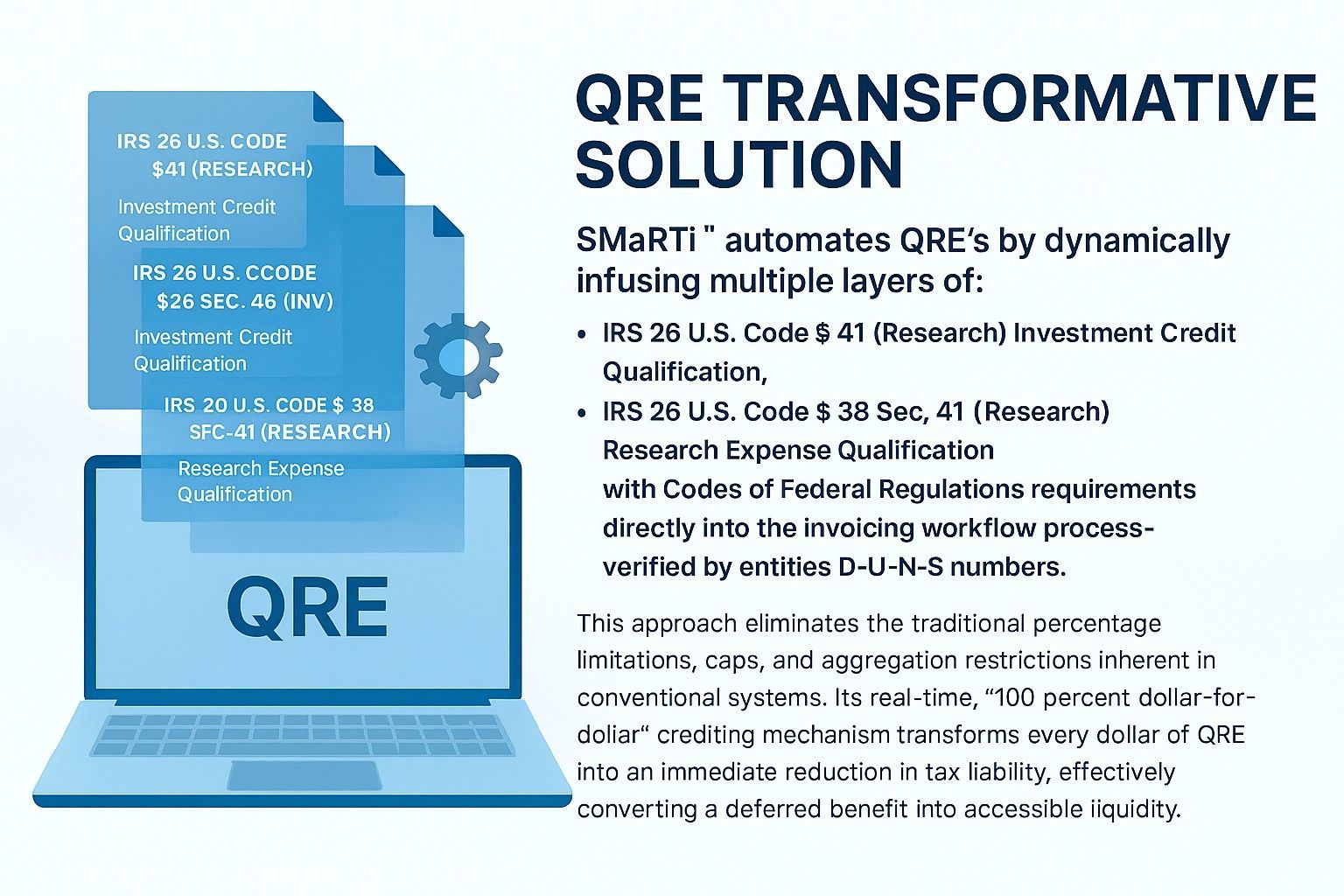

- Automated Data Capture: Every invoice in SMaRTi™ is scanned for expense items that qualify as Qualified Research Expenses (QREs) infusion. Each automated line item is queried under the IRS-defined criteria for research and development spending.

- Regulatory Cross-Check: For each QRE, SMaRTi™ automatically cross-references multiple iterations of rules embedded in the Internal Revenue Code (IRC) and the Code of Federal Regulations (CFR).

- Entity Identification: By associating each invoice with a D-U-N-S number (and/or Legal Entity Identifier), the system ensures that the validation is entity-specific.

This deep integration within the invoicing workflow means that by the time an invoice is finalized, every QRE line item has been vetted and approved in real time, eliminating the delays and uncertainties typical of manual or end-of-year reconciliations.

II. Direct, Immediate Conversion into Tax Liability Reduction

- Eliminating Deferred Recognition: Traditionally, QREs are recorded as deferred tax assets—benefits realized only at period-end or during tax filing. SMaRTi™, however, converts each dollar spent on qualified research immediately into a tax credit.

- Overcoming Traditional Hurdles: Traditional tax credit systems often have percentage limits, caps, or aggregation rules that block full immediate crediting. SMaRTi’s "100 percent dollar-for-dollar" approach eliminates these obstacles altogether.

- Direct Pay Mechanism: Once a QRE is validated, SMaRTi™ posts the corresponding credit directly to the invoicing record. This acts as a direct pay against the tax liability. As soon as the invoice is generated, the tax credit is applied immediately—transforming the accounting treatment from a deferred benefit into an immediate reduction.

III. Integrated Invoicing Workflow with Compliance by Design

- Dynamic Rule Engine: At its core, SMaRTi™ employs an algorithm that is documented and validated under IRC 6001 to meet all four criteria-qualifies as a QRE. Each issued invoice is automatically enriched with the latest IRC and CFR regulatory interpretations, while advancing the principles of the UN Sustainable Development Goals (SDG), pursuant a 5PL structure—under NAICS 541614— combined with its SMaRTi® process.

- Systematic Financial Optimization: By integrating this process directly into the financial workflow, the system avoids traditional reconciliation bottlenecks. Rather than waiting for a consolidated end-of-year tax computation, each invoice becomes a live document reflecting real-time tax liability adjustments.

- Operational Efficiency and Liquidity Boost: This immediate credit mechanism not only ensures compliance but also transforms the tax credit into an operational asset. Companies can immediately deploy these funds—savings from the reduced tax liability—to further enhance research activities or bolster operational initiatives. Such integration means no additional manual steps are required to realize the value of the tax credits.

Instead of capital being locked up as a deferred asset waiting for annual settlement (with the attendant risks of percentage limitations, caps, or aggregation thresholds), the company has those funds available immediately—

optimizing cash flow and fostering reinvestment in future innovation.

In essence, SMaRTi™ reshapes the financial narrative for companies by ensuring that every dollar of QRE isn’t just accounted for; it’s actively leveraged as an immediate reduction in tax burden, thus superseding conventional limitations and amplifying liquidity benefits under IRS rules creating an auditable trail for all embedded tax credits under the requirements of IRC 6001.